Hope for Hemp: New Opportunities and Challenges for an Old Crop

The reintroduction of industrial hemp through State pilot programs showed potential for a crop last commercially produced in the United States in the 1950s. Industrial hemp, a crop grown historically for fiber, seed, oil, and now cannabidiol (CBD) oil, is the plant Cannabis sativa L. and any of its parts with a very low concentration of delta-9 tetrahydrocannabinol (THC), the psychoactive ingredient in marijuana. Clearly distinguishing industrial hemp from marijuana was a critical legal step in allowing hemp production to restart in the United States. Production levels grew rapidly with new producers coming into the market.

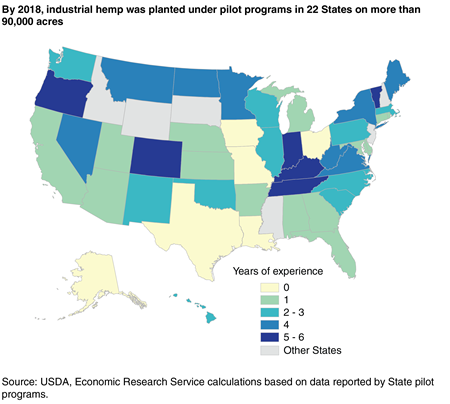

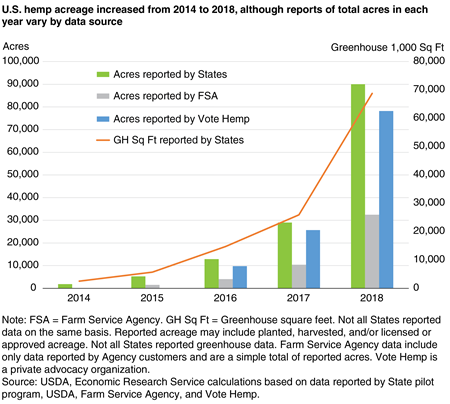

U.S. industrial hemp acreage reported by State pilot programs increased from zero in 2013 to over 90,000 acres in 2018, the highest acreage since 1943, when 146,200 acres were planted. While the U.S. hemp industry grew rapidly and commercial hemp production was legalized again by the 2018 Farm Bill, the industry’s long-term economic viability is uncertain.

State pilot programs ushered in rapid growth of the hemp industry

The revival of the U.S. industrial hemp industry began slowly then accelerated, as is evident in the figure comparing U.S. hemp acreage by varying data sources. In 2014, only four States (Colorado, Indiana, Kentucky, and Vermont) reported hemp planted on a total of 1,866 acres. While additional States had regulations and licensing procedures under development, they were unable to pass legislation or establish acres; Colorado alone accounted for 97 percent of that acreage. The earliest pilot programs, established in 2014 and 2015, were not necessarily the largest by 2018. While Colorado, Kentucky, and Oregon licensed individual growers and expanded their programs quickly, some other early pilot programs remained small experimental projects. Indiana, for example, reported only 5 planted acres of hemp in 2015 and by 2018, that number had only grown to 16 acres. In contrast, by 2018, nationwide 22 States reported hemp planted on over 90,000 acres.

Some States licensed both greenhouse space and field acreage in the pilot programs. In 2018, 13 States reported only field production; 9 additional States reported both field and greenhouse growers. Like field acreage, greenhouse plantings grew rapidly between 2014 and 2018. By 2018, Colorado alone had nearly 5 million square feet (approximately 114 acres) of greenhouse hemp. Some of the greenhouse space is used for growing seedlings, clones, and seeds, instead of growing plants for harvest.

Nationally, the number of producers reported to have approved hemp licenses increased from 292 in 2014 to 3,852 in 2018, although many of these producers were small, with an average cultivated area under 20 acres. Because of various legal and logistical issues, such as lack of appropriate seeds, uncertainty in production methods, and other factors, not all the licensed producers planted hemp or planted as many acres as they had licensed. However, the number of approved licenses more than doubled between 2017 and 2018, showing a growing interest in production.

Hemp industry information is scarce for U.S. growers

The hemp pilot programs were successful in restarting production of a crop that had not been grown in the United States for decades; however, reintroducing a crop to the agricultural landscape came with challenges. One challenge for the hemp industry is the lack of basic production and market data and information fundamental to making informed decisions. For example, lack of research on agronomic best practices for hemp or relative profitability with alternative commodities can lead to risky decision making.

The absence of data on the size and location of growers, buyers, and competitors in this fast-developing industry was identified as a significant challenge during the pilot programs. For example, producers often struggled to identify a buyer for their crop even as processors struggled to identify or contract sources of hemp. Annual reports from the State pilot programs themselves eventually provided some data, although data collected varied widely between States. The documented economic information focused on fees assessed by State programs and employment levels of the pilot programs, and level of detail and definitions of data collected vary significantly from State to State. Advocacy organizations also collected and published some information on the growing hemp industry. The USDA, Farm Service Agency began reporting data on planted hemp acres with the 2015 crop year from the subset of U.S. growers who participate in other FSA programs. Beyond basic data, agronomic and economic research on hemp is in its infancy with most current information published in non-peer reviewed journals or online. While that information can be widely accessible, it is often difficult to distinguish quality or applicability beyond a single circumstance.

Hemp markets are global

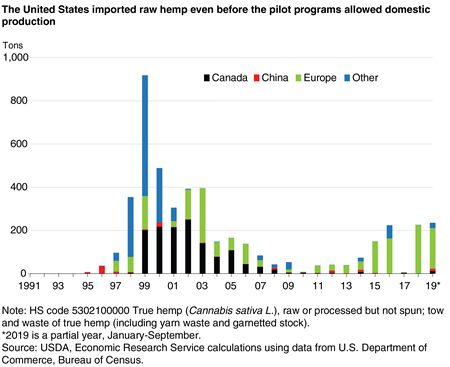

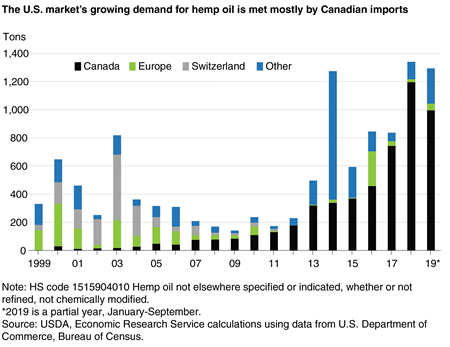

While the reintroduction of hemp production in the United States is relatively recent, hemp production had already been legal in other parts of the world. Globally, production was small and relatively stable until the recent worldwide interest in CBD oil, driven by its perceived health benefits. The United States imported raw and processed hemp and hemp oil from many countries, even when domestic production was illegal. Although import volumes, particularly for processed hemp and hemp oil, were small before 2014, they have since increased. Canada, Europe, and China are major foreign hemp-producing regions and may prove to be formidable competitors for an emerging U.S. industry in the future based on their historical production figures. Those regions could potentially expand exports quickly if the demand for CBD oil proves to be long lasting and local regulatory regimes are supportive. At the same time, the United States exports some hemp products. Prices derived from a robust market will rely not only on domestic supply and demand, but international production and consumption.

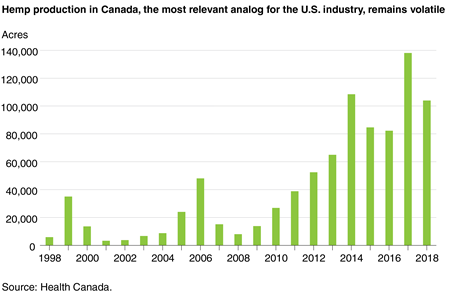

Canada is perhaps the most relevant analog for the U.S. hemp industry. Canada’s modern hemp industry developed following a similar legislative and policy path as the U.S. industry, but it began 20 years earlier. In 1994, the Canadian government offered experimental research licenses for hemp production. In 1998, commercial production became legal in Canada with grower licenses and other regulatory provisions covering production, processing, transporting, delivery, sale, and trade provided by Health Canada. Canada has historically exported hemp to the United States, and in the last decade, U.S. imports of Canadian hemp oil have increased.

Hemp production has a long history in Europe and was an important source of canvas and rope for European navies as far back as the 1700s. The European hemp industry has remained relatively small, partly because of the high cost of specialized equipment to handle hemp fiber and limited demand for textile and food uses of hemp. The European Union (EU) subsidized fiber crops, including hemp, as part of the Common Agricultural Policy—the EU’s version of the U.S. Farm Bill - in the 1970s, but later phased out most of the support programs. Like trends in Canada, European hemp production is rebounding in response to expanded demand for organic seed for food consumption and the emerging demand for CBD oil products. Europe continues to supply raw and processed hemp to the United States.

While the current regulatory and legal environment in China is evolving, and data sources for China’s hemp production differ, it is likely China is the world’s largest industrial hemp producer as of 2019. Hemp has been grown in China for thousands of years for textile and fiber use and many sources cite that it was first cultivated in China. Much of the available industry equipment for processing hemp is from China. As a low-cost producer with agronomic expertise, China is capable of quickly mobilizing production and has rapidly expanded production since 2014. Most the hemp produced in China is likely retained for the domestic market and not exported, but China’s data on this commodity remains unclear.

The U.S. hemp industry continues to evolve

The pilot programs for industrial hemp authorized in the 2014 Farm Bill were successful in restarting production of a crop that had not been commercially grown in the United States for decades. The 2018 Farm Bill addressed many of these challenges highlighted by the pilot programs or authorized subsequent regulations to address them. While the numbers of planted acres and participants in the U.S. industrial hemp industry increased rapidly under the pilot programs, and hemp can now be grown legally in nearly every State, the long-term trends for U.S. industrial hemp are uncertain. Lack of reliable, transparent data and peer-reviewed research and market information continues to be a challenge. Market dynamics will change quickly, especially during development of a new industry, as producers enter and increase production and demand patterns shift. Hemp is an international market and competition with alternative crops for acreage, relative competitiveness, market transparency, and the ability to manage regulatory and market risks will determine patterns of development in the emerging U.S. hemp industry.

This article is drawn from Economic Viability of Industrial Hemp in the United States: A Review of State Pilot Programs , by Tyler B. Mark, Jonathan Shepherd, David W. Olson, William Snell, Susan Proper, and Suzanne Thornsbury, ERS, February 2020

Source: Amber Waves Magazine, USDA